E3模拟题(一)

Question One

TFR business sectors

T Railways has two strategic objectives (pre-seen pages 3 and 4). In order to assist in the evaluation of its performance in achieving these strategic objectives and to manage its operations effectively, TFR is split into three business sectors. These business sectors are based upon customer groups and the type of freight transported for each customer group. Each of these customer groups has different expectations of the service offered by TFR. The total revenue generated by TFR in the year ended 31 December 2012 was T$516 million.

1. Consumer and Heavy Goods (CHG):

This sector transports everyday consumer goods such as clothes, foodstuffs and electrical products for large retail companies throughout Country T. It also transports large industrial products for the construction industry, such as steel, cement and concrete blocks. This business sector currently provides 50% of the revenues of TFR’s business. This sector transports freight to, and from, a number of large strategic rail freight warehouses located throughout Country T.

The delivery of retail goods is relatively simple logistically but often involves the movement of large numbers of small items. The delivery of construction goods is often complex, involving a range of different suppliers of the industrial products. It requires the use of specialist loading equipment and multiple drop-offs and pick-ups at a number of rail freight warehouses.

CHG freight transportation is undertaken by both diesel and electric trains. A number of Country T’s large supermarket chains are currently considering the impact of their supply chain upon the environment and are looking for ways to reduce their carbon emissions. They are currently largely reliant on deliveries to their stores by road haulage and are evaluating the environmental benefits of switching more of their deliveries from road to rail freight. Many of the large construction companies in Country T take a different view and prefer the convenience of direct deliveries of construction materials to their construction sites, a service which is offered by road freight haulage. The main concern for many of the construction companies is the competitiveness of the price charged by road haulage providers and the punctuality of delivery.

2. Energy:

This sector transports coal to the nationalised power stations within Country T. TFR transports 90% of Country T’s coal production used in its national electricity generation. This business sector currently provides 40% of the revenues of TFR’s business. TFR operates dedicated tracks between coal mines in Country T and the national power stations and so is not reliant on using the main passenger track facilities. TFR uses its oldest diesel freight trains to transport coal supplies to the power stations. These trains have limited power availability to pull larger numbers of coal trucks. The power station operators are concerned that the number of journeys made by TFR is increasing their own staffing and management costs. The power station operators are putting increasing pressure on TFR to reduce the number of journeys made to the power stations because they are charged for each journey that is made by TFR.

3. Automotive:

This is a relatively new area of business for TFR, involving the transportation of new cars from car manufacturing facilities within Country T to ports in neighbouring countries. This business sector currently provides 10% of the revenues of TFR’s business. TFR has recently invested in 20 new fuel-efficient electric freight trains, specially designed to transport cars. This type of freight haulage is a relatively simple process as it does not involve complex lifting or multiple loading operations nor does it require the use of TFR’s rail freight warehouses. TFR has to meet tight deadlines for delivery times to ports. However, as the Automotive sector operates on the main passenger track facilities, its freight trains are sometimes delayed by passenger services which take priority on Country T’s rail network. As the ports are in neighbouring countries, the Automotive sector’s trains are reliant upon other countries rail networks to meet its deadlines.

Road freight haulage

Approximately 80% of Country T’s freight haulage by volume is delivered by road and is carried out by many different private road haulage companies. The total revenue generated by the road freight haulage sector in the year ended 31 December 2012 was approximately T$3,770 million. Road freight haulage has been the main method of freight transportation within Country T for the last 40 years, largely due to the convenience of providing door-to-door deliveries. However, the demand for road freight haulage in favour of rail freight haulage has slowed recently, due to the introduction of road toll charges on Country T’s major motorways and the ever worsening traffic congestion on Country T’s roads. Also, recent legislation has been introduced by Country T’s Government to restrict lorry drivers’ hours of work and distances travelled per journey. In addition, Country T’s Government is committed to reducing carbon emissions and has encouraged greater use of rail rather than road haulage for the transportation of freight.

Benchmarking

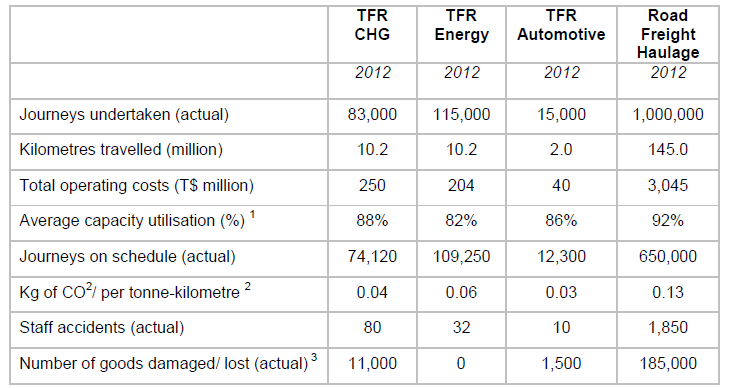

TFR undertakes an annual benchmarking analysis of its three business sectors, in order to compare their performance and to assess the performance of TFR in total against the road freight haulage sector. This benchmarking analysis involves the measurement of a number of Key Performance Indicators (KPIs) and is used by T Railways to assist in the evaluation of the achievement of its strategic objectives. Some of the information which TFR used to measure its KPIs in the year ended 31 December 2012 is shown below.

1 This is the KPI and has already been calculated in the table above.

2 This is the KPI and has already been calculated in the table above.

3 Measured in terms of number of goods damaged/lost per 1,000 kilometres travelled.

As part of its annual benchmarking exercise, TFR also calculates the average operating cost per kilometre travelled and operating profit per kilometre travelled for each of the three business sectors and for TFR in total.

Privatisation of TFR

In other countries, such as the United Kingdom and Sweden, the privatisation of nationalised rail freight operations has been highly successful. A number of neighbouring countries of Country T have private rail freight operators. One organisation, Q Corporation, which currently owns and operates a private rail freight company in a neighbouring country, has approached Country T’s Government with an offer to buy TFR. Q wishes to operate TFR as Country T’s main rail freight operator, but as a private company. Q would invest significantly in TFR, and upgrade many of the current strategic rail freight warehouses, replace old diesel engines with electric engines and invest heavily in infrastructure and staff training.

Q is of a similar size to TFR but operates with only 60% of the number of employees compared to TFR. Q operates with a decentralised management structure where business sector senior managers are responsible for strategic decision making and also set their own strategic objectives. The emphasis of strategic management and planning is on core competences and critical success factors in each of its business sectors, unlike TFR which operates an accounting-led approach to strategic management and planning. Q plans to re-organise TFR into two separate companies:

• the ‘Retail Freight Company’ which would comprise the retail and supermarket customer business (currently part of the CHG sector) together with the ‘Automotive’ sector business

• the ‘Industrial Freight Company’ which would comprise the construction customer business (currently part of the CHG sector) and the ‘Energy’ sector business.

Q’s shareholders are keen for this proposal to be accepted as they feel that the acquisition of TFR will have a positive impact upon their long-term shareholder value.

Required:

(a) Discuss the difficulties faced by T Railways, as a public sector organisation, in setting and measuring strategic objectives.

(b) Using the information presented in the benchmarking analysis for the year ended 31 December 2012,

Evaluate

• the comparative performance of the three business sectors within TFR;

• the performance of TFR as a whole against the road freight haulage sector.

Note: There are 10 marks available for calculation of the KPIs

(c) If TFR were privatised,

(i) Discuss how the culture of TFR would be likely to change;

(ii) Discuss how the strategic management and planning activities of TFR would be likely to change.