2011 CPA Exam-Frequently Asked Questions

What are the changes coming to the CPA exam in 2011?

On January 1, 2011, under the heading of Computer Based Testing evolution (CBTe), the USCPA will roll out a large number of significant changes to the current CPA exam. These changes can be divided into two groups: topical changes that change the subjects being tested, and functional changes that alter the way the exam is delivered and scored.

Topical Changes for 2011:

The USCPA developed and released a final version of new (CSOs/SSOs) in the Fall of 2009. The CSO determines the topics that will be tested on the exam and the new version reduces or removes some topics from the exam, but on balance greatly increases the breadth of topics you'll encounter and need to prepare for. For example:

International Financial Reporting Standards (IFRS) will be fair game in three of the four exam parts. Amongst other things, in Auditing and Attestation (AUD) you'll need to be familiar with the International Auditing & Assurance Board (IAASB) and its role in establishing International Standards on Auditing (ISAs). In the Financial Accounting and Reporting (FAR) section you'll be asked to identify and understand the differences between financial statements prepared on the basis of US GAAP and under IFRS. In Business Environment and Concepts (BEC) questions will test your grasp of globalization in the business environment.

Ethics, as it pertains to tax returns, legislation and industry driven ethics remains in the Regulation (REG) exam. At the same time a new Professional Responsibilities section in AUD will focus on ethics and independence for AUD related items e.g. audits, reviews, compilations, compliance etc. This amounts to a doubling of the Ethics coverage on the CPA Exam.

And these are just a couple of the changes. Topics such as the personal financial statement and tax exempt entities will be back after a 7 year hiatus from the exam. You'll also encounter Corporate Governance, Project Management, Multi Jurisdictional Tax issues and Financial Instruments for the first time.

For even more information on how the content of the exam is changing, watch our recording of a presentation given in February by Elaine Rodeck, the USCPA's Director of Examinations Strategy:

Functional Changes for 2011:

As if the changes to the content being tested on the exam weren't enough, CBTe will introduce changes to the structure, function and weighting of the Uniform Certified Public Accountant's Exam. Let's cover the two items getting the most attention before discussing broader changes.

Task Based Simulations (TBS): The current exam includes 2 classic simulations, each with 6-8 tabs containing tasks tied to a common scenario, often with information from one tab featuring in the solution of another. The new Task Based format will present one testlet with 6 or 7 stand alone tabs, each with a different self-contained task. Plan to spend 5-10 minutes on each.

TBS will also house a new research format. CPAexcel has seen a early demonstration of the TBS from the USCPA and while the new research format does not appear to be a large departure from the current functionality, it's something you want to be familiar with before exam day.

We already know that the FASB Accounting Standards Codification will be included in the Authoritative Literature database, but you may also see IASB, UCC or other types of literature in the simulations. We'll update this page as we learn more.

Written Communication: The constructed response format will no longer feature in the AUD, FAR and REG exams. Instead, BEC will get 3 written communication tasks covering topics related to the Business Environment area. Each will take 5-10 minutes to complete, though it's ultimately up to the candidate to carve out the time from the overall BEC area.

• Responses must generally be on topic but the three main criteria are

o Organization – structure, ordering of ideas and the linking of ideas

o Development – presentation of supporting evidence

o Expression – use of standard business English

• Unless the candidate is close to the passing score cut-off, constructed responses will be computer graded

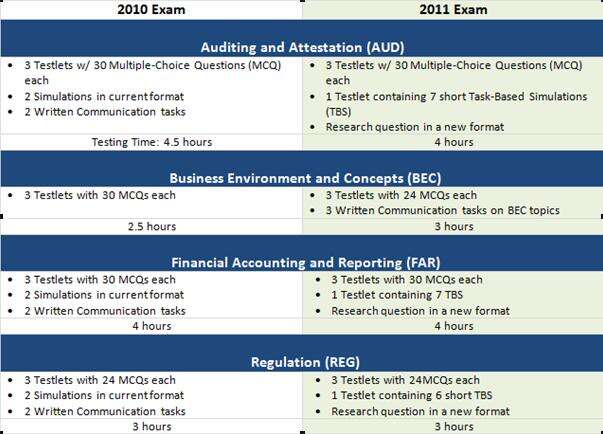

• Structure and Time: The CPA exam will still be a 14 hour exam but AUD will be a little shorter and BEC will receive a little additional time. The following table summarizes the structural and time differences coming to the exam:

Scoring Weights: Finally, the score weightings

相关阅读

一名USCPA讲师对中国考生的建议2013/06/13

高顿USCPA学习指导--Simulation题型说明2013/06/09

如何科学制订你的USCPA学习计划2013/06/06